Malaysia SST-02 Return

Under Malaysia’s Sales and Service Tax system, registered taxpayers are required to declare Sales and Service Tax Return (SST-02) every two months according to the taxable period. The International Tax Reports SuiteApp supports the generation of Malaysia SST-02 Returns. Each tax return form is available in both English and Bahasa Malay languages.

To generate the Sales and Service Tax report for Malaysia, use the tax code properties provided by the International Tax Reports SuiteApp. See Malaysia SST Tax Codes.

NetSuite calculates the amounts for Part B2 (Value of Tax Payable for Goods / Services) of the Sales and Service Tax Returns based on the recorded sales and service transactions. However, some boxes in the form require users to manually input the data.

NetSuite cannot audit data entered manually. To record your changes, use the Print button to save your report as a PDF file. For more information, see Generating VAT/GST Reports.

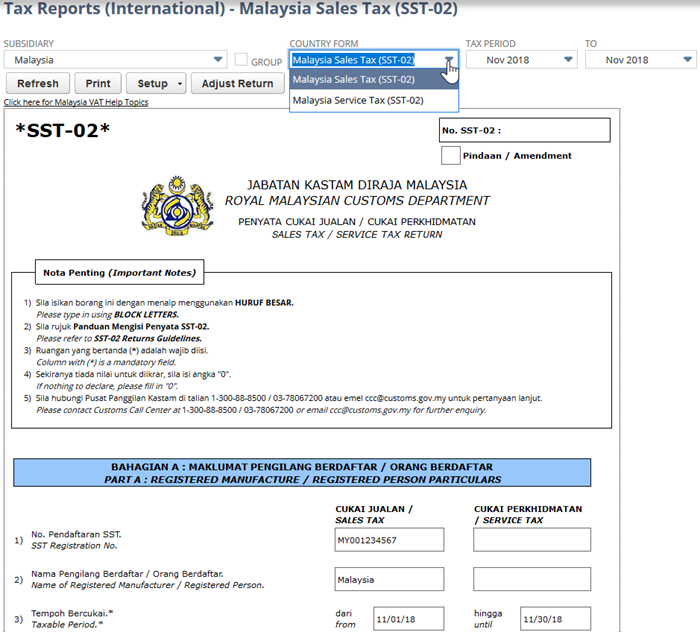

Generating Malaysia Sales Tax (SST-02) Return or Malaysia Service Tax (SST-02) Return

You should review all values in your Sales and Service Tax reports. Select the values in the boxes of the VAT report to view details. To understand how NetSuite uses the tax codes to get the values for the Malaysia Sales and Service Tax Returns (SST-02), refer the following topics:

To generate the Malaysia Sales or Service Tax Returns (SST-02):

-

Go to Reports > VAT/GST > Tax Reports (International).

-

Select the applicable subsidiary of Malaysia nexus on the Subsidiary field.

Note:For OneWorld accounts, select the applicable subsidiary of Malaysia nexus on the Subsidiary field.

-

Select Malaysia Sales Tax (SST-02) or Malaysia Service Tax (SST-02) on the Country Form field.

-

Select the applicable report period on the Tax Period and To fields.

-

Click Refresh.

Refer to the screenshot below to view the Malaysia Sales and Service Tax reports.